With global electricity demand rising, Canada faces a nuclear dilemma

WASHINGTON, D.C. — With global electricity demand expected to rise 25 per cent by 2030, nuclear energy will play an essential role in meeting the world’s power needs. Canada’s rich uranium reserves give it a position of strength in bolstering global energy security — and possibly in securing a place at the forefront of a nuclear renaissance. Given this year’s trade tensions between the United States and Canada, recent decisions, such as embracing U.S.-origin Small Modular Reactors (SMRs) and the newly announced Cameco, Brookfield, Westinghouse $80 billion U.S. reactor deal, raise important questions. Is Canada pursuing nuclear sovereignty or ceding control to foreign interests? “We’re talking about tens to hundreds of billions of dollars of spending,” says Chris Keefer, president of Canadians for Nuclear Energy and host of the weekly energy podcast, Decouple. “Do we want that spent within the Canadian economy with the accompanying economic multipliers, or do we want to say, ‘We have a national inferiority complex, so we’ll just run with what the Americans are doing, use their technologies, and not think strategically about national benefit?”

Canada’s uranium is a strategic asset, but recent industry choices suggest growing dependence on U.S. technology, enrichment, and markets — potentially limiting Ottawa’s control and future industrial benefits. SMRs require enriched uranium that Canada cannot supply, and the Cameco deal positions Westinghouse reactors under U.S. systems, raising questions about whether Canada is becoming a passive supplier rather than a nuclear leader — or, as Prime Minister Mark Carney puts it, an “energy superpower.”

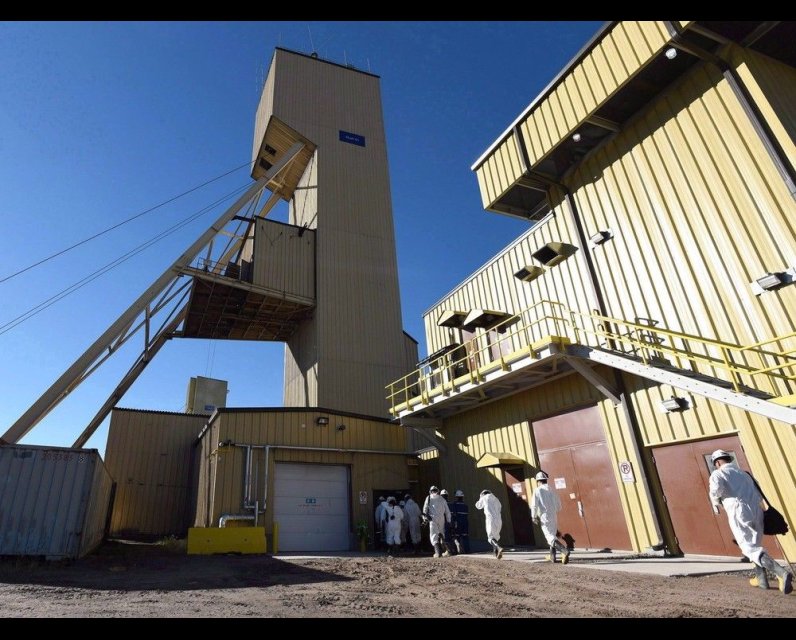

Canada’s great uranium advantageCanada has some of the world’s best uranium mining and supplies roughly a quarter of global uranium output. This, according to Jack Spencer, senior research fellow for Energy and Environmental Policy at the Washington-based Heritage Foundation and author of the new book, “Nuclear Revolution,” gives Ottawa economic leverage.

On top of that, uranium prices have risen almost 30 per cent from this year’s lows, with demand pushing upward thanks to the advent of AI data centres and the West’s bid to wean itself from Russian and Kazakh uranium supply amid the Russia-Ukraine war.

“We have the potential AI boom coming and we, for the first time, have electricity use projections pointing upwards,” said Spencer. “So we have this increase in demand and, at the same time, an attempt to decrease supply from Russia while simultaneously having a fairly rigid production on the uranium field side.”

This should, according to Jessica Kennedy, a regulatory lawyer with Bennett Jones, put Canada’s uranium at the top of the list as the West seeks uranium from “politically aligned partners,” giving it geopolitical leverage.

A good deal?On Tuesday, news dropped of an $80 billion Cameco-Brookfield-Westingthouse deal with the U.S. government to fund Westinghouse AP1000 reactor deployment in the United States. The deal is to be backed by Japanese financing, thanks to the $550 billion Technology Prosperity Deal forged with President Donald Trump in July — for which Tokyo saw its tariff rate lowered to 15 per cent.

“Cameco will do very well … it’s going to gain value with this Japanese investment,” said Keefer. “But it’s a little bit like borrowing Peter to pay Paul,” he added, referring to how Japan is making large investments to avoid punitive tariffs.

Canada’s industrial benefits, meanwhile, are indirect and financial, creating few jobs and not expanding energy infrastructure domestically.

“I don’t see Canada as really being a massive beneficiary here,” added Keefer.

Some experts believe the deal offers Canada a strategic advantage in the long term.

“I think it’s great from a Canadian perspective,” said Heather Exner-Pirot, a senior fellow and director of Energy, Natural Resources and Environment at the Macdonald-Laurier Institute. “People might not like that we’re doing deals with the United States right now, but we are absolutely tying American nuclear power to the Canadian supply chain, and that is good for Canada.”

“It gives you leverage going into the long-term nuclear reactors,” she added.

But the deal ties Canadian nuclear companies more closely to U.S. market demands and energy policy, which some fear makes them vulnerable to U.S. policy fluctuations — and we’ve seen a fair few of those this year alone.

At the same time, Canada is also adopting some U.S. nuclear technology.

Toying with techCanada is investing billions in U.S. Small Modular Reactor (SMR) projects in Ontario, Saskatchewan, and Alberta. SMRs require enriched uranium, and since Canada does not enrich uranium – it only mines and converts it – it will need foreign suppliers for fuelling these reactors.

By contrast, Canada’s 17 homegrown CANDU reactors use unenriched uranium, requiring no foreign supply.

Some experts say leaning in on SMRs is smart as they’re smaller than conventional reactors and modular, making them easier to ship and build in remote locations.

Kennedy noted that SMRs are the hot ticket in nuclear energy at the moment as “they’re perceived as being more versatile in their uses and ability to locate where they’re needed.”

Others would prefer that Canada stick with its unique CANDU technology and only use unenriched uranium.

“I think it would be incredibly foolish for (Canada) to basically bury CANDU reactor technology and take on US-origin reactor technology, both at the small level of the SMRs, which (Canada has) already done, and at the larger level,” Keefer said.

“It would make (Canada) dependent on the largess of the US and how much of the supply chain they want us to have.”

Red tapeAs Canada expands its nuclear portfolio, it must contend with a complex regulatory environment at home. Deploying SMRs requires navigating overlapping federal-provincial reviews, Indigenous consultations, and a separate licensing regime under the Canadian Nuclear Safety Commission.

Kennedy says that both mining and reactor approvals take years due to the multi-layered regulations.

Another challenge looms: Without a domestic enrichment industry, Canada will depend on imports to fuel the SMRs.

That’s a weakness, according to Jay Hu, executive chairman and CEO of U.S.-based LIS Technologies, which specializes in uranium enrichment.

“Canada lacks the ability to process the whole fuel cycle,” he said.

“If Canada would actually focus on building up enrichment … the U.S. would be the biggest buyer,” Lu added, noting how the U.S. still gets a fair bit of enriched uranium from Russia and Europe and would prefer a closer source.

So far, the economics have not driven towards enrichment in Canada, but Kennedy believes that could change as demand for SMRs expands. Government backing for enrichment could emerge, she said, as leaders recognize the job creation and energy security benefits.

Kennedy also drew an analogy to oil refining, warning that relying on U.S. and foreign-enriched uranium might lead to controversy at home: “They’re generating all that upside in the U.S., and it limits our ability to be completely independent from their refining capacity.”

Geopolitical hot potatoThanks to Russia’s invasion of Ukraine, the global dynamics around nuclear energy and fuel have shifted. To wean itself off of Russian or Kazakh uranium, the United States needs to source plenty of uranium, expand its nuclear reactor fleet, and rebuild its ability to enrich uranium, the infrastructure for which has been stagnating for decades.

Russia and China, meanwhile, are ramping up their nuclear and enrichment capabilities, for both domestic consumption and export.

As for Canada, it’s at a nuclear crossroads, and the decisions made now will define how independent and globally influential it will be in the nuclear space for decades to come.

The country’s high-quality uranium reserves offer a natural advantage, but experts warn that recent industry deals for obtaining U.S.-origin reactors and involvement in the tripartite Cameco deal could undermine Canada’s nuclear sovereignty.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our newsletters here.

Comments

Be the first to comment